Perspectives on the use of Precision Financing Solutions

In 2017 and 2019, FoCUS conducted two surveys that aimed to assess payer perspectives regarding the current and future management of cell and gene therapies (CGTs) with one-time administration. A white paper titled “Payer Perspectives on Financing and Reimbursement of One-time High-cost Durable Treatments” published in October 2019 summarized three major findings for payers:

- Payers are concerned about financial risk and impact of CGTs.

- Payers are motivated to manage the financial risk associated with CGTs differently, making this a high priority over the next two years.

- Addressing contract terms and barriers will matter.

FoCUS conducted a new survey of payers and developers in summer 2022 to update our prior work and gain new insights from developers into the unique reimbursement challenges of CGTs. Questions focused on the current experience of and plans for respondents’ organizations in implementing alternative payment models. The full survey methodology and results have been published here Payer and Developer perspectives on alternative payment models: Expert Review of Pharmacoeconomics & Outcomes Research (tandfonline.com)

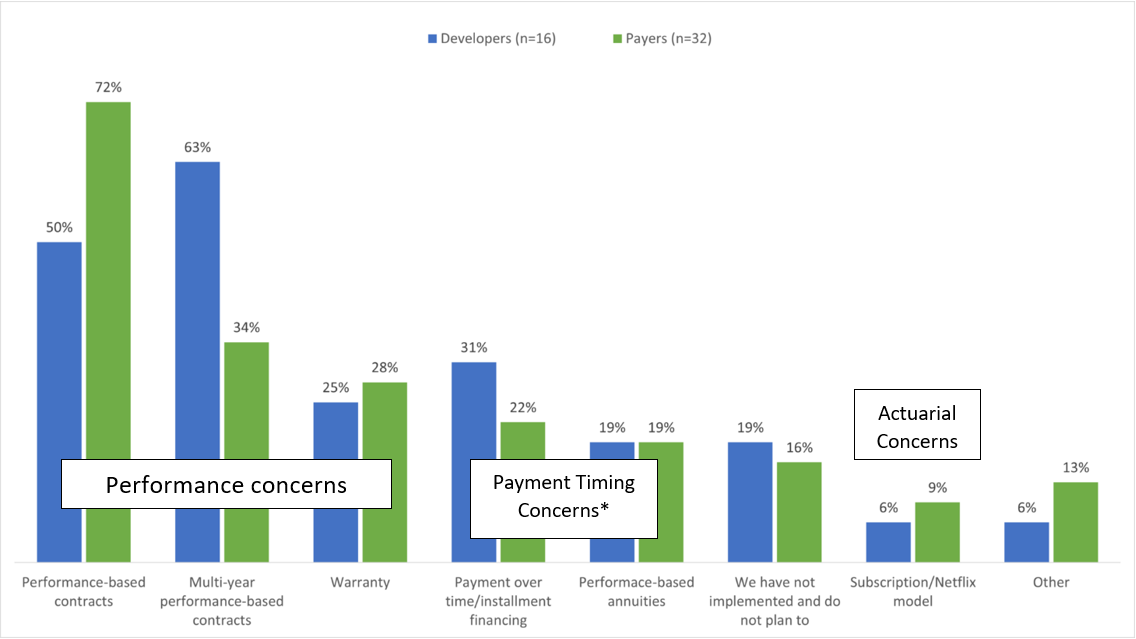

FoCUS designed two surveys, one with 12 questions for developers and one with 17 questions for payers. Only developers with at least one cell and/or gene therapy on the market or in their pipeline were invited. Among 16 developers and 32 payers who responded to the survey, 81% and 84% respectively, had or planned to implement a Precision Financial Solution addressing performance, payment timing, or actuarial needs (Figure 1).

Figure 1. Use of Precision Financing Solutions (Source; Figure 1)

*Performance based annuities address timing and performance concerns.

Factors motivating Precision Financing Solutions

Overall, the survey results show that payers and developers are aligned in several areas for the development of Precision Financing Solutions. There remain, however, differences in motivation between each party that inform which alternative payment models to pursue.

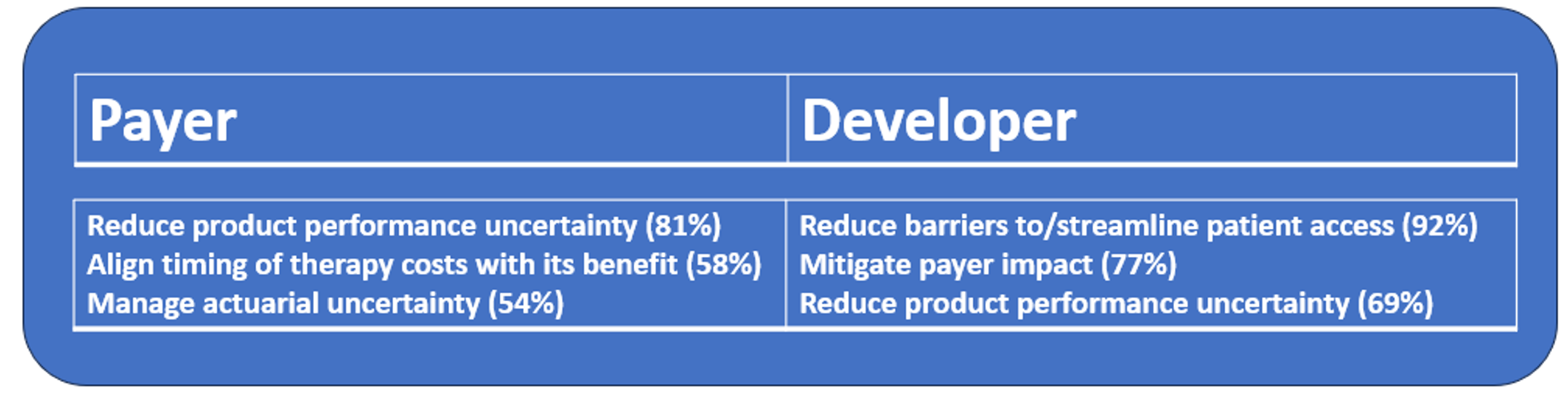

Developers were more focused on access, with the most common response being ‘Streamline patient access’ (92%). The most common payer response was ‘Reduce product performance uncertainties’ (81%). Payers and developers are aligned in desiring to reduce performance uncertainties. Similar goals are expressed with managing actuarial uncertainty and mitigating payer impact. These shared objectives provide a promising basis for continued discussions on alternative payment models.

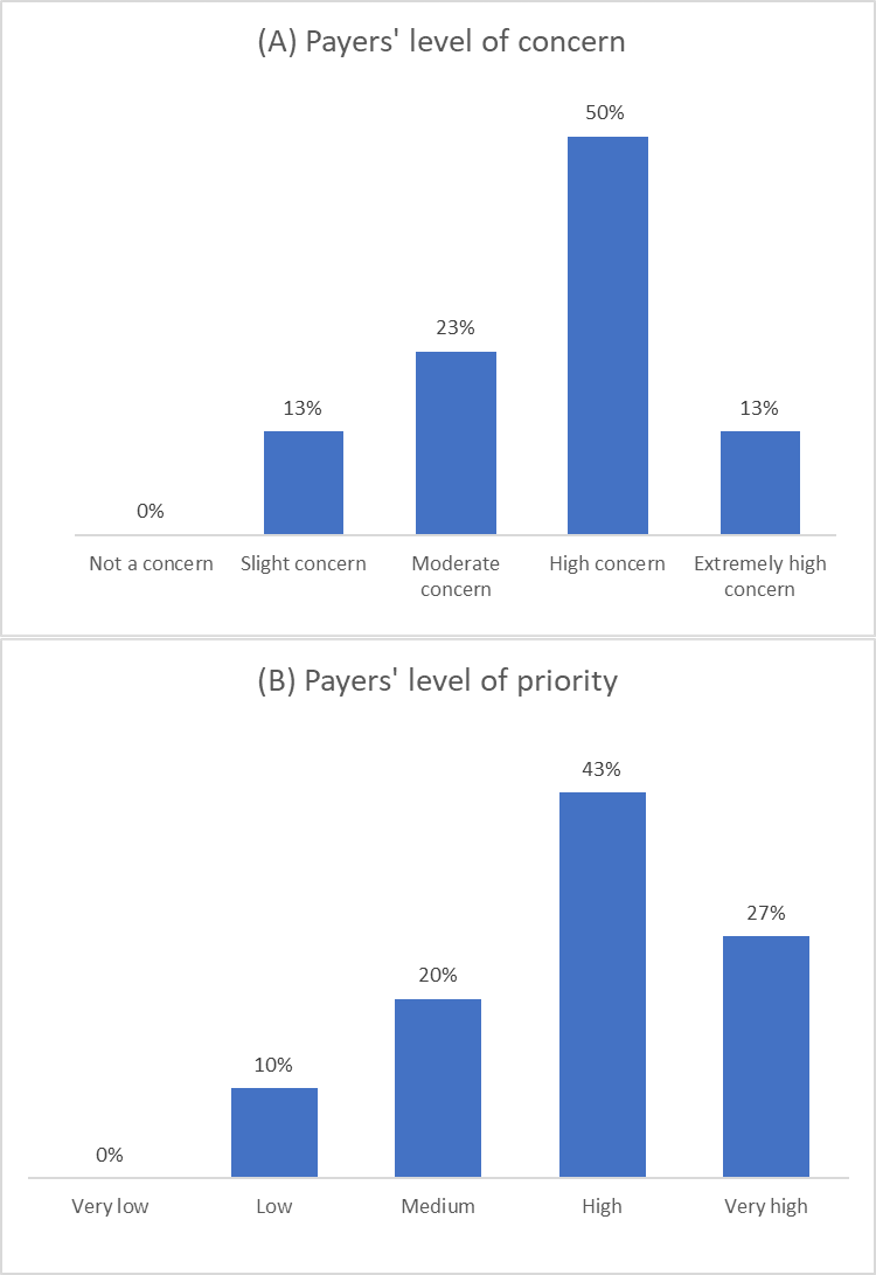

Figure 2. Payer responses to concerns/priority of managing cell and gene therapy. (Source; Figure 8)

Notably, 62% of responses from developers stated that “Interest or request from payers” had influenced their organization’s decision to pursue an alternative payment model. Developers have the opportunity to consider the financial aspects of covering cell and gene therapies that are of high concern to payers and bring solutions to negotiations. In general, understanding the other party’s motivations is essential for developing contracts that appeal to both parties.

Payers were asked about the level of concern at their organization regarding the financial risk and impact of CGTs, and the priority for managing new CGTs. Results showed most respondents had a high to very high concern (63%) regarding the financial risk and high to very high (70%) level of priority. (Figure 2)

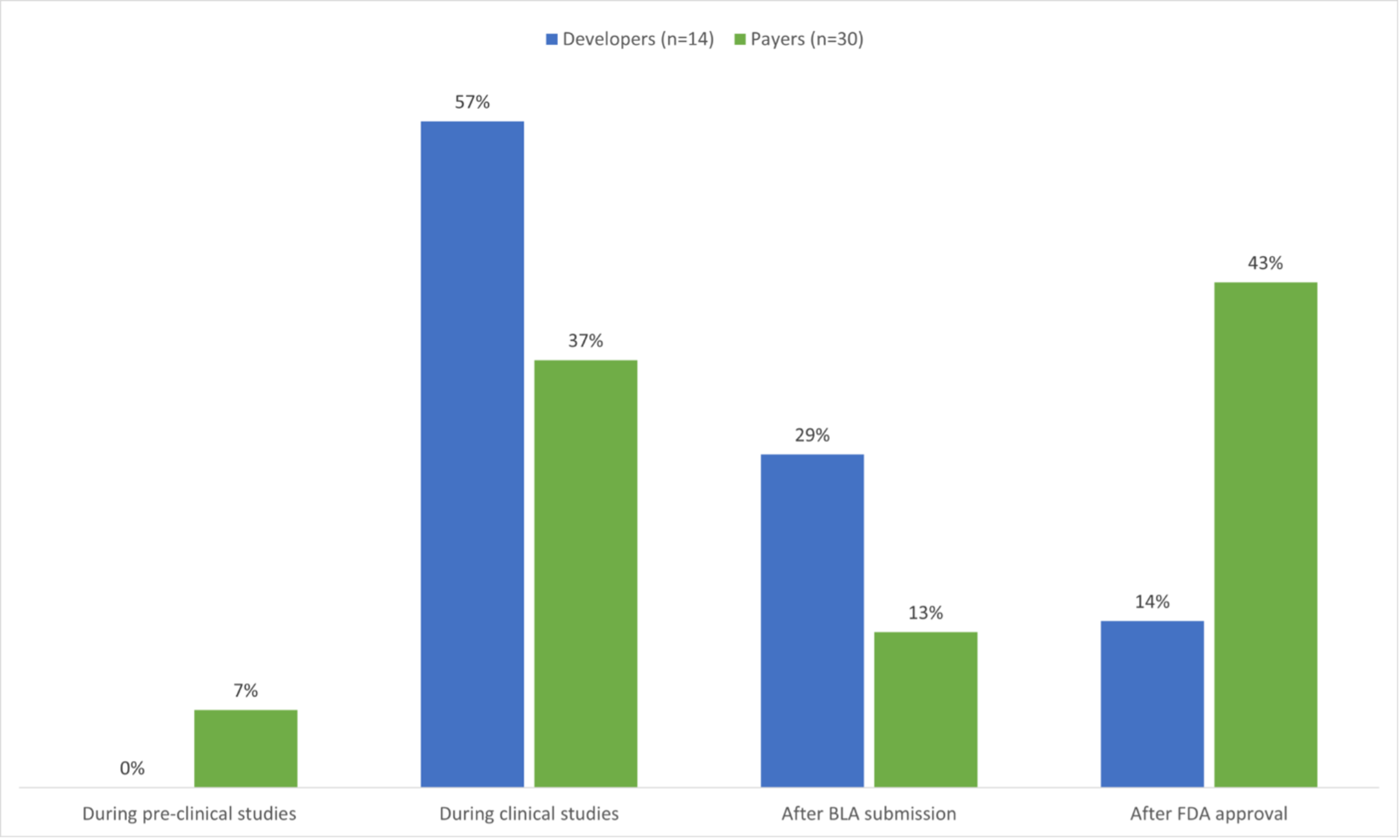

When developers were asked if their organization engaged in early dialogue with payers during the drug development process, most developers stated that they engaged during clinical trials (57%) or after BLA submission(29%). Payers stated that they tended to engage developers after FDA approval (43%) or during clinical studies (37%).

Figure 3. Responses to the question: When does your organization currently engage in early dialogue with payers/developers during the drug development process? (Source; Figure 6)

Based on the survey results, developers are interested in discussing financial risk management strategies much earlier — at the clinical trial stage — whereas payers want to wait until regulatory approval, given that developers cannot ensure clinical trial success or regulatory approval. This suggests that most developers are engaging with a subset of early adopting payers, with 44% of payers and a few developers waiting until it is certain that patient access and contracting decisions must be made. Most clinical trials, even in rare diseases with few patients, have early readouts of efficacy and safety that can be indicative of future results. One option to encourage such early engagement among stakeholders may be to begin alternative payment model discussions at logical trial milestones, with standardized approaches that aim to ease progression toward final contracting once a product is on the market. Another option may be for developers to actively seek payer input on alternative payment models in early clinical trials, to understand how payers might approach reimbursement for a life-changing and likely high-cost therapy.

Despite high levels of interest from both payers and developers, Precision Financing Solutions remain limited in use. Challenges for implementation include the operational complexity and administrative burden of implementing agreements, and legal and regulatory uncertainties. More information regarding these issues can be found at the links below.