Financial challenges of CGT

Durable, potentially curative therapies create three financial challenges:

1. Payment timing: Therapies can involve substantial upfront payment for multiple years of therapeutic benefit.

For a single payer, this can mean a mismatch between costs and expected benefits. The payer will have concentrated costs in the year of a patient’s treatment while patient benefits and cost savings will be realized over many years. Moreover, as patients may switch payers over time, the first payer may incur the costs and future payers may benefit from reduced longer-term costs.

2. Therapeutic performance risk: Real-world efficacy and durability are uncertain at the time of initial regulatory approval and market launch.

Payers may need to address two types of uncertainty as they evaluate whether to cover and how to reimburse gene and cell therapies:

1. Uncertainty as to the expected benefits of treatments in a broader, real-world population, given that regulatory approval will be based on limited clinical trial data and real-world results are sometimes different from clinical trial results; and

2. Uncertainty as to whether the benefits will be durable and if not, how long they will last

3. Actuarial risk: The number of eligible patients in a payer’s population may be uncertain and could vary significantly from period to period.

Health plans with relatively few covered lives are unlikely to have patients needing a particular rare product in a given year, but a single case could have large cost consequences if the risk is not managed.

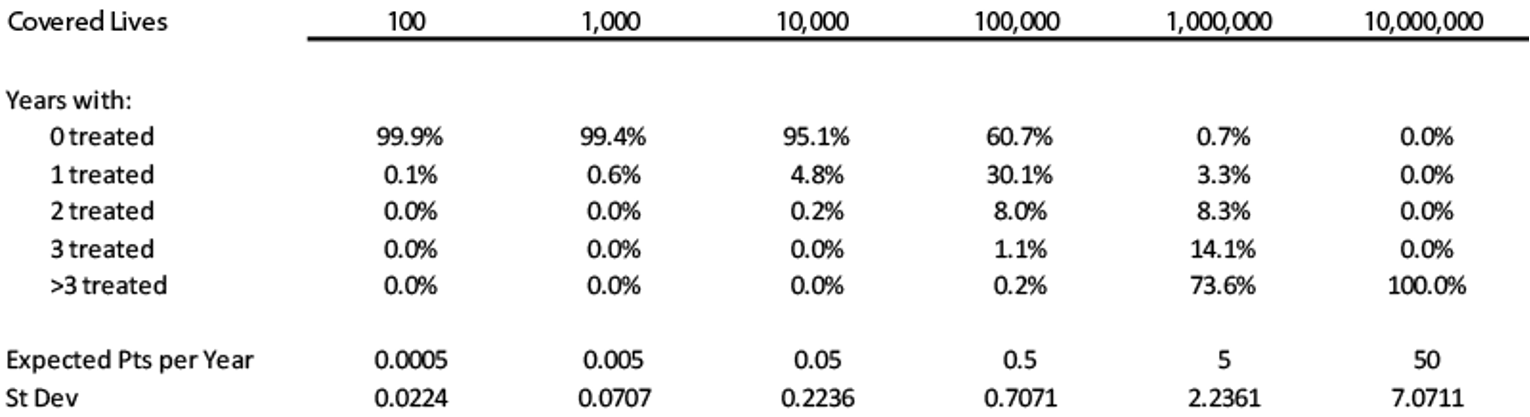

The table below shows the likelihood of health plans of different sizes covering a patient in a given year who could benefit from a new treatment for a very rare condition.

Hypothetical Example: Product with US incidence of ~1,600 patients—Number of Patients Per Year by Health Plan Size

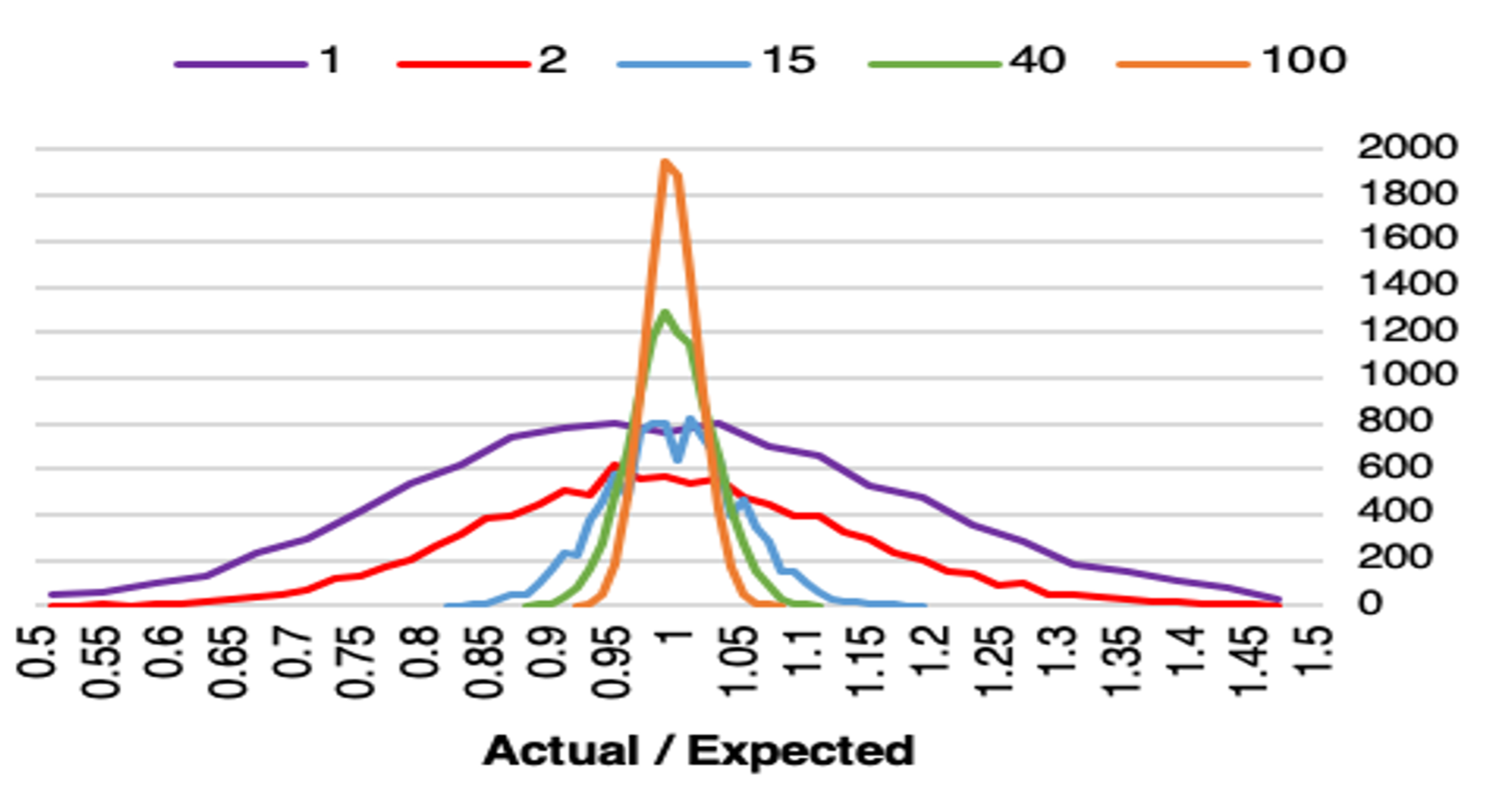

The above analysis focuses on a single new treatment considered in isolation. In a portfolio of products, uncertainty will be dampened because it is unlikely that all products will have similarly high utilization levels in the same year. The figure below shows the simulated results of portfolios with different numbers of uncorrelated new products. As you can see, with only one product (purple curve), the curve of actual to expected patients is relatively flat and spread out around 1. It is hard to be actuarially certain that the estimated number of products will be correct in actual practice. With 100 products (orange curve), the ability to predict accurately increases and the band is very tight around one (1). Therefore, as the number of products increases, uncertainty and average portfolio risk decline.

Illustrative—Distribution of Actual Patients vs. Expected Patients

Many conditions outside of oncology have relatively substantial prevalent patient population sizes compared with their annual incidence. The prevalent population refers to those who have a specific characteristic or condition in a given time period, and are already living with the disease or condition, such as hemophilia or sickle cell disease. Depending upon adoption and patient access, the treatment of a prevalent population will peak, and then will decline as numbers of untreated patients decline. Approval of the first product for an indication with a prevalent population will have the uncertainty of adoption of the product by patients and providers. The timing of when and how many treatment events will occur will be difficult to project and will initially be similar to the actuarial risk of an incident population.

Payers will not all be equally affected by these therapies and risks. US payers cover different number of lives (size), types of lives covered (children, elderly, mixed), funding sources (self-funded, premiums, taxes), and the coverage/ reimbursement rules. For example, Medicare and larger commercial insurers face less actuarial risk than self-insured employers, regional commercial plans, and some state Medicaid plans due to the significantly larger number of lives they cover. Therefore, smaller payers may need financial solutions addressing actuarial risk more than larger payers. Similarly, some payers may cover clusters of patients with certain genetically driven conditions that occur in families and therefore have a larger number of members who might benefit from a particular therapy compared to other payers.